Ensure compliance with Mexico’s General Law for the Protection of Personal Data in Fintech. Discover actionable AI-driven strategies for secure marketing growth and effective risk management, including regulatory technology solutions.

As AI transforms fintech marketing, it brings opportunities for innovation and significant challenges in meeting regulatory compliance. For fintech companies operating in Mexico, balancing advanced marketing strategies with adherence to Mexico’s General Law for the Protection of Personal Data in Possession of Obligated Subjects (GLPPDOS) is essential to avoid penalties and build trust. This regulatory framework is crucial for financial technology security standards and consumer protection, forming a key part of fintech legal requirements.

This guide offers actionable steps for complying with Mexico’s data protection laws while leveraging AI to drive growth in fintech marketing and implementing robust fintech risk management practices.

Understanding the General Law for the Protection of Personal Data in Mexico

Mexico’s data privacy framework is built around two systems, which are essential for digital banking compliance:

- Federal Law for the Protection of Personal Data Held by Private Parties (FLPPPP): Governs private entities, including fintech companies.

- Regulations for Public Data: Applies to public-sector organizations.

The National Institute for Transparency, Access to Information, and Protection of Personal Data (INAI) oversees compliance, conducts audits, and penalizes violations. This regulatory body plays a crucial role in shaping the regulatory landscape for fintech companies and enforcing GLPPDOS regulations for fintech.

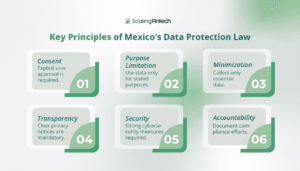

Key Principles of the Law

- Lawfulness and Consent: Obtain explicit permission before collecting personal data.

- Purpose Limitation: Use data only for specified and legitimate purposes.

- Data Minimization: Collect only what’s necessary for your stated objectives.

- Transparency: Provide clear privacy notices before collecting data.

- Security: Implement robust cybersecurity measures to protect personal data.

- Accountability: Maintain evidence of compliance efforts.

Important Note: Handling sensitive data like biometric or financial information requires written consent, and violations carry twice the penalties of standard breaches. This underscores the importance of a comprehensive compliance program and adherence to fintech compliance requirements.

The Role of AI in Fintech Marketing

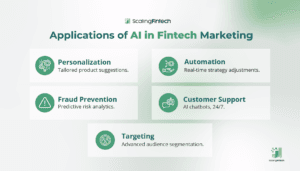

How AI Transforms Fintech Marketing

AI is revolutionizing fintech marketing by enhancing customer targeting and operational efficiency. Key applications include:

- Personalized Customer Experiences: AI analyzes transaction patterns to suggest tailored products.

- Automated Decision-Making: Real-time adjustments to marketing strategies.

- Fraud Prevention: Predictive analytics to identify risks and fraudulent behavior.

- Customer Engagement: AI-powered chatbots for 24/7 support.

- Improved Targeting: Advanced analytics to identify high-value market segments.

Privacy Challenges in AI-Driven Marketing

However, AI’s reliance on vast datasets creates privacy risks. Challenges include:

- Large-scale data collection exposes sensitive information.

- Ensuring transparency in automated decision-making processes.

- Balancing personalization with compliance to Mexico’s data protection laws and international standards like GDPR compliance.

Steps to Ensure Compliance in AI-Driven Fintech Marketing

1. Data Minimization and Purpose Limitation

- Actionable Tip: Limit data collection to what’s strictly necessary for marketing goals and regulatory reporting, including know-your-customer (KYC) requirements.

- Example: Use anonymized transaction data to optimize fraud detection without storing unnecessary personal details.

2. Obtaining and Managing User Consent

Build a dynamic consent management system:

- Get explicit permission for specific uses.

- Keep consent logs for audits.

- Make withdrawal easy through dashboards or portals.

Example: A fintech app allows users to opt out of targeted ads while still accessing essential services, adhering to KYC and anti-money laundering (AML) requirements.

3. Enhancing Data Security

- Actionable Tip: Implement enterprise-grade security, including encryption, access controls, and regular AI system audits as part of your cybersecurity measures and fintech data protection measures.

- Example: End-to-end encryption protects customer financial data across its lifecycle, supporting transaction monitoring and AML efforts.

4. Ensuring Transparency in AI Algorithms

- Actionable Tip: Use Explainable AI (XAI) techniques to clarify how decisions are made, addressing regulatory requirements for transparency.

- Example: Provide customers with a summary of factors influencing credit scoring decisions.

5. Conducting Regular Privacy Audits

Regular audits help identify compliance risks and maintain adherence to regulatory requirements:

Audit Components:

- Data Flow Analysis: Check collection points and data movement.

- Compliance Verification: Review consent management and security measures.

- Risk Assessment: Identify vulnerabilities and mitigation steps.

- Documentation Review: Ensure policies are up-to-date and aligned with the current regulatory landscape.

Best Practices for Ethical AI in Fintech Marketing

1. Building Bias-Free AI Models

- Use diverse datasets to avoid discriminatory outcomes.

- Monitor for biases regularly.

- Adopt adaptive learning systems for continuous improvement.

2. Privacy-First AI Development

- Use differential privacy techniques to protect individual data points.

- Apply federated learning for decentralized AI model training.

- Ensure encryption protocols exceed standard requirements and align with fintech cybersecurity standards.

3. Communicating Privacy Practices

- Simplify privacy notices with clear, concise language.

- Regularly update customers on data use policies.

- Highlight how privacy measures enhance their experiences and support consumer protection.

Addressing Common Compliance Challenges

Handling Data Breaches

A structured approach to breaches ensures swift action:

- Immediate Response: Contain the breach and notify regulatory bodies within 72 hours.

- Assessment: Document affected data and evaluate impact.

- Communication: Transparently inform affected customers.

- Prevention: Update security protocols and enhance monitoring systems.

Third-Party Vendor Compliance

Vendors handling customer data must meet compliance standards:

- Conduct thorough background checks.

- Include data handling clauses in contracts.

- Perform regular audits of vendor practices.

Balancing Personalization with Privacy

Use privacy-preserving techniques like:

- Federated Learning: Train AI models without direct access to raw data.

- Differential Privacy: Aggregate insights without exposing personal details.

Case Studies: Successful Compliance in AI Marketing

1. Kueski

- Challenges: Scaling credit assessments while protecting customer data.

- Solution:

- Minimized data collection to essential fields.

- Transparent opt-in consent system.

- Clear explanations of AI-driven decisions.

2. Clip

- Achievements:

- Processed over 40 million transactions securely.

- Integrated compliance checks into marketing automation.

- Used privacy-preserving AI for fraud prevention.

Both companies successfully implemented GLPPDOS regulations for fintech, serving as models for compliance best practices.

Building a Privacy-First Fintech Marketing Strategy

Key Components

- Data Architecture: Incorporate privacy-preserving analytics.

- Customer Control: Enable self-service dashboards for consent management.

- Technology Stack: Use encrypted systems and secure APIs.

- Marketing Automation: Implement consent-driven personalization.

Benefits

- Increased customer trust and loyalty.

- Lower compliance costs and reduced regulatory risks.

- Competitive differentiation in Mexico’s fintech market.

How Scaling FinTech Can Help

Scaling FinTech specializes in AI-driven, compliance-focused advertising solutions to align your FinTech marketing efforts with GLPPDOS requirements and other financial regulations. Our regulatory technology (RegTech) solutions can help you navigate the complex world of fintech compliance.

- Precision: Tailored campaigns that balance growth and compliance.

- Transparency: Real-time reporting on data usage and campaign performance.

- Client-Centric Growth: Strategies designed to maximize ROI while maintaining regulatory adherence.

Get Started Today: Book a free consultation to navigate Mexico’s data protection framework effectively and implement robust compliance strategies.

Conclusion: Driving Innovation While Ensuring Compliance

Balancing AI innovation with data protection compliance is essential for fintech success in Mexico. By adopting privacy-first practices and adhering to fintech privacy regulations, fintech companies can build trust, reduce risks, and achieve sustainable growth in the evolving regulatory landscape.

Take Action: Partner with Scaling FinTech to align your marketing strategies with compliance requirements and gain a competitive edge in the industry. Our RegTech solutions can help you navigate the complex world of fintech compliance and stay ahead of evolving fintech legal requirements.

FAQs

1. What is the General Law for the Protection of Personal Data in Possession of Obligated Subjects?

A Mexican law ensures privacy and data security for individuals by regulating how personal data is collected, processed, and shared, forming a crucial part of the fintech regulatory framework.

2. How can fintech companies ensure compliance? By implementing robust consent management, limiting data collection, conducting regular audits, and using privacy-preserving AI technologies. This includes adopting comprehensive compliance policies, staying abreast of regulatory changes, and utilizing compliance automation tools.

3. Why is compliance important in fintech marketing? Compliance builds trust, avoids penalties, and enhances customer loyalty, ensuring long-term growth in a competitive market. It also helps fintech companies navigate the complex regulatory landscape and maintain regulatory oversight while meeting fintech compliance requirements.