Discover how AI transforms APRA compliance in fintech advertising. Streamline processes, enhance accuracy, and mitigate risks with actionable tips and solutions for effective risk management and compliance risk management.

Navigating compliance with the Australian Prudential Regulation Authority (APRA) is a significant challenge for fintech companies. Regulatory standards evolve rapidly, requiring marketing teams to create innovative campaigns that engage audiences while adhering to stringent compliance obligations and prudential standards. This is particularly crucial in the realm of financial technology and financial services, where operational risk and compliance risk are constant concerns.

AI is changing how fintechs approach APRA compliance. It offers tools to streamline processes, improve accuracy, and reduce risks. This blog explores how AI is changing compliance in fintech ads. It offers tips, examples, and best practices to help your business thrive while meeting regulations like APRA CPS 230.

Understanding APRA Compliance for Fintech Advertising

What is APRA?

APRA is a regulator. It ensures financial stability and consumer protection in Australia. APRA oversees assets of over AUD 13 trillion. It enforces rules to ensure ethical practices in financial institutions, including fintechs. The Senate plays a role in overseeing APRA’s activities and the implementation of standards like CPS 230.

Key Compliance Areas for Fintech Advertising

APRA’s guidelines significantly impact fintech advertising strategies, focusing on:

- Financial Licensing: Ensuring advertisements include correct licensing disclosures, including information about restricted ADI licenses where applicable.

- Consumer Protection: Avoid misleading or deceptive marketing, as mandated by the Corporations Act 2001 and ASIC Act.

- Privacy and Data Protection: Safeguarding sensitive consumer information during campaigns, is crucial for data management and cyber resilience.

- Anti-Money Laundering: Implementing measures to detect fraudulent activities in advertising practices, is particularly important for digital wallets and other fintech products. For anti-money laundering measures, consult the Australian Transaction Reports and Analysis Centre (AUSTRAC).

- Risk Disclosures: Accurately representing financial risks in marketing materials, a key aspect of compliance risk management.

Why Compliance Matters

Non-compliance with APRA regulations can lead to:

- Fines and Penalties: Many fintechs have faced penalties exceeding AUD 2 million for breaches.

- Reputation Damage: Regulatory violations erode consumer trust and tarnish brand credibility.

- Operational Disruptions: Non-compliance may lead to license suspensions. This can disrupt business operations and affect continuity.

Action Tip: Make a compliance checklist for all marketing campaigns. Highlight key disclosures and risk information. This should include a compliance risk assessment to identify potential issues before they arise.

The Role of AI in APRA Compliance

Why AI is Transformative

AI excels at analyzing large datasets. It can identify compliance risks in real time and automate repetitive tasks. It helps fintechs keep up with regulations and improve compliance. This is key for managing operational and third-party risks.

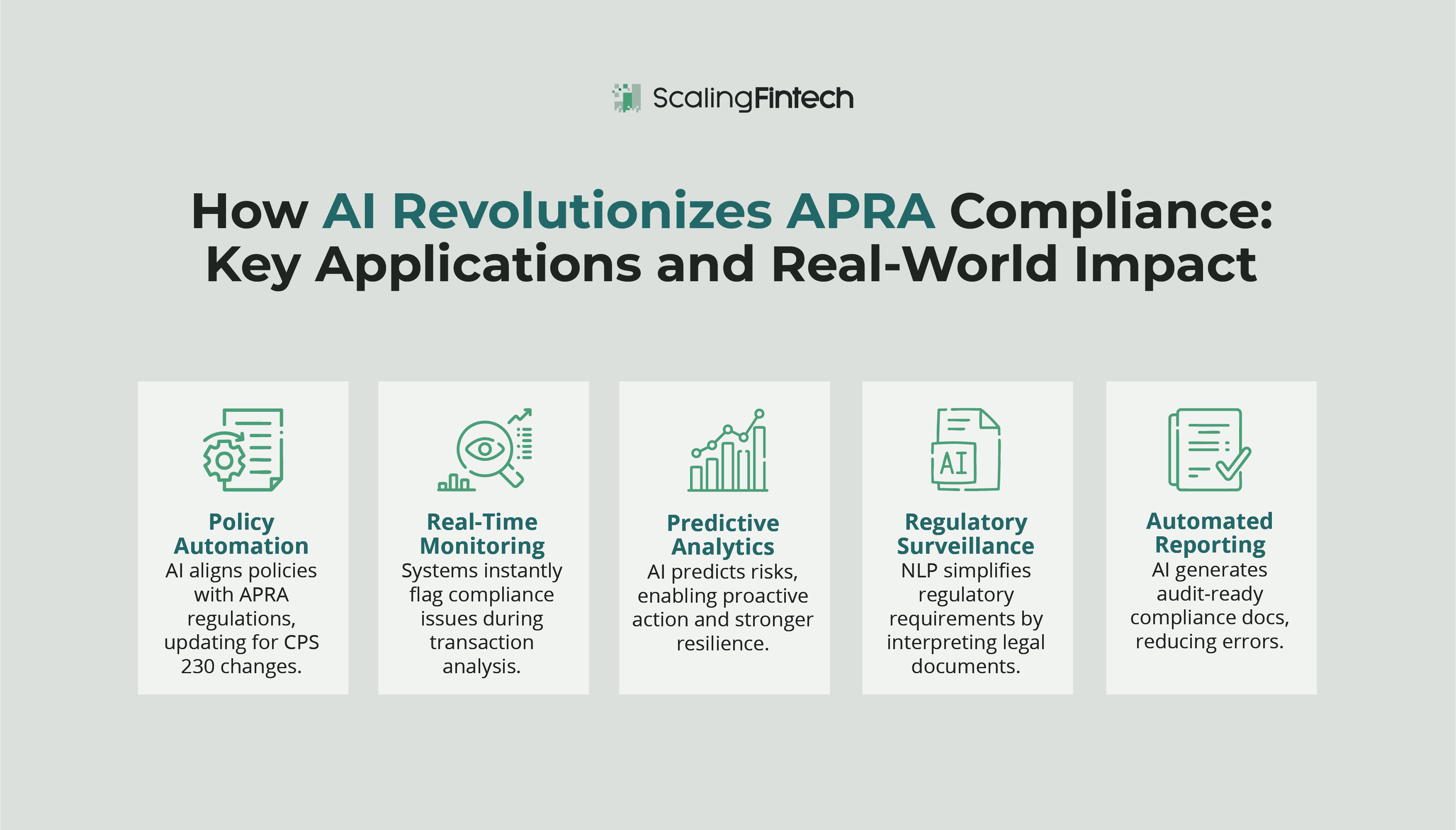

Core Applications of AI in Compliance

AI provides fintech companies with powerful tools to manage APRA compliance:

- Policy Automation: AI aligns internal policies with APRA regulations, automatically updating them as rules change, including updates to CPS 230 requirements.

- Real-Time Monitoring: Systems analyze millions of transactions instantly, flagging potential compliance issues and supporting incident management.

- Predictive Analytics: AI anticipates compliance risks, enabling teams to address them proactively and enhance operational resilience.

- Regulatory Surveillance: Natural language processing (NLP) interprets legal documents, simplifying regulatory requirements and supporting compliance risk management.

- Automated Reporting: AI generates consistent, audit-ready compliance documentation, reducing manual errors and supporting data strategy initiatives.

Example: A fintech firm used AI-driven fraud detection to cut compliance review times by 60%, expediting campaign approvals and reducing operational bottlenecks. This approach aligns with the CPS 230 effective date requirements for improved risk controls.

Key Benefits of AI for Fintech Advertising Compliance

1. Streamlined Compliance Processes

- AI automates routine tasks, such as tracking regulatory changes and reviewing marketing content, significantly reducing manual workload.

- Machine learning algorithms adapt compliance frameworks dynamically to align with evolving APRA guidelines, including updates to CPS 230 operational risk management standards.

2. Enhanced Accuracy and Transparency

- AI systems maintain detailed audit trails, ensuring accountability for compliance decisions and supporting software escrow requirements.

- Real-time monitoring tools detect inconsistencies across campaigns, ensuring regulatory adherence across channels and supporting supplier risk mitigation efforts.

3. Proactive Risk Management

- Predictive analytics enable early identification of compliance risks, allowing teams to address potential issues before they escalate, a key aspect of line 1 risk management.

- Fraud detection algorithms improve detection rates by 30% and reduce false positives by 50%, enhancing overall risk management strategies.

Action Tip: Use AI-powered compliance dashboards to track real-time campaign performance, identify risks, and optimize advertising strategies dynamically. This approach supports comprehensive compliance risk management and aligns with APRA CPS guidelines.

Overcoming Challenges in AI Adoption for Compliance

1. Algorithmic Bias

AI systems may inadvertently develop biases, leading to discriminatory outcomes in areas like ad targeting or loan approvals.

Solution:

- Train AI models using diverse datasets.

- Conduct regular audits to identify and address biases.

- Implement cross-demographic testing and continuous model refinement.

2. Data Privacy Concerns

Protecting sensitive consumer data requires strong safeguards. This is vital for privacy and compliance. This is especially true for digital wallets and other fintech products.

Solution:

- Use advanced encryption protocols to protect data.

- Apply Privacy-Enhancing Technologies (PETs) to anonymize consumer information without compromising AI effectiveness.

3. Lack of Transparency in AI Models

Complex AI algorithms are often “black boxes.” It’s hard to explain their decision-making. This can cause issues for compliance risk management.

Solution:

- Use XAI frameworks, like SHAP. They provide clear, interpretable insights into decision-making.

- Document all AI compliance activities. This shows accountability to regulators and stakeholders. It also supports efforts to be more resilient.

Best Practices for AI-Driven Compliance in Fintech Advertising

- Align AI Strategy with Compliance Goals

- Form an AI governance committee. It will oversee compliance and ensure alignment with APRA CPS standards.

- Regularly train teams on APRA regulations, including CPS 230, and AI capabilities.

- Invest in Transparent AI Solutions

- Use XAI tools to document compliance decisions comprehensively, supporting software escrow requirements.

- Keep detailed records of training data, decision logic, and audit results. They will support compliance risk management efforts.

- Monitor and Update AI Models Continuously

- Regularly check model performance for biases. Fix any issues. This ensures it meets risk management goals.

- Incorporate new regulatory updates promptly into AI frameworks, including changes to CPS230 requirements.

Action Tip: Schedule quarterly audits. They will ensure AI systems meet APRA’s evolving requirements, including updates to CPS 230 and other standards.

Leveraging RegTech for APRA Compliance

What is RegTech?

Regulatory Technology (RegTech) bridges the gap between innovation and compliance, providing fintech companies with intelligent automation tools tailored to APRA’s guidelines and supporting overall risk and compliance efforts.

How RegTech Enhances Compliance

- Real-Time Monitoring: It tracks ad campaigns across platforms. This ensures compliance and manages risk.

- Automated Reporting: Generates accurate, audit-ready documentation efficiently, aligning with CPS 230 requirements.

- Risk Analysis: It finds weaknesses in advertising strategies. It offers insights to help manage compliance risks.

Example: A fintech cut compliance reporting work by 70%. It used RegTech to automate data mapping and documentation. This improved its ability to meet APRA CPS standards.

Case Studies: AI Success Stories in APRA Compliance

SafeGuard Financial

- Achieved a 75% improvement in regulatory breach detection.

- Reduced compliance incidents by 50%.

- Lowered false positives by 80% in fraud detection, enhancing overall risk management.

FiscalGuard Group

- Used AI-driven compliance systems to cut auditing times by 70%. This met APRA guidelines, including CPS 230 on operational risk management.

Lessons Learned from Compliance Failures

- Amazon: Biased AI algorithms harmed its reputation. This shows the need for strong compliance risk management.

- COMPAS faced legal challenges for racial bias in its risk models. This highlights the need for transparent AI in financial services.

Takeaway: To maintain trust, we need AI governance and bias audits. We also need transparent decision-making. This is especially true for APRA CPS standards and software escrow requirements.

Preparing for the Future: Evolving APRA Regulations

Emerging Trends

- CPS 230 requires more algorithmic transparency and accountability.

- Stricter governance requirements for AI systems, impacting risk controls and operational resilience.

- Enhanced cross-border regulatory collaboration, affecting the licensing framework for fintech companies.

Proactive Strategies

- Establish a governance framework. It must meet APRA’s evolving requirements, including updates to CPS 230.

- Use predictive analytics to anticipate regulatory changes and support compliance risk management.

- Align AI adoption with international standards, such as the EU’s AI Act, to enhance global compliance efforts.

Stay updated on APRA’s policy and regulation changes through their official page.

How Scaling FinTech Can Support APRA Compliance

Scaling FinTech offers AI ads for fintechs in Australia. They ensure full risk and compliance management.

Why Partner with Scaling FinTech?

- Precision: Customized campaigns aligned with APRA guidelines, including CPS 230, and growth objectives.

- Transparency: Real-time reporting ensures accountability and visibility, supporting compliance risk management efforts.

- Client-Centric Growth: Strategies maximize ROI while embedding compliance safeguards and supporting operational continuity.

Get Started Today: Book a free consultation to see how Scaling FinTech can turn compliance into a competitive edge. We can help you with APRA CPS standards and software escrow rules.

Conclusion

AI is transforming how fintech firms manage APRA compliance. It offers tools to improve accuracy, streamline processes, and reduce risks. AI and RegTech can help fintechs. They can turn compliance from a burden into a strategic asset. It will support risk management and resilience.

Would you like to enhance your compliance framework? Contact Scaling FinTech. Discover how AI can drive growth and innovation. It will keep you compliant with APRA, CPS 230, and other key standards.

FAQs

1. What is APRA’s role in fintech advertising?

APRA regulates financial institutions to ensure ethical ads and protect consumers. It enforces standards like CPS 230.

2. How does AI enhance compliance efforts?

AI automates compliance tasks, like monitoring, reporting, and risk assessment. It improves accuracy and cuts costs. It also supports risk management.

3. What is RegTech, and how does it help?

RegTech simplifies compliance with smart automation and real-time monitoring. It uses advanced analytics to support risk and compliance management.

4. What challenges do fintechs face with AI compliance?

Common challenges include algorithmic bias, data privacy, and lack of transparency in AI. These can hurt compliance risk management efforts.

5. How can Scaling FinTech support compliance?

Scaling FinTech provides AI-driven, tailored Ads solutions that meet APRA’s CPS 230. They ensure compliance and growth while supporting software escrow and operational continuity.