Introduction: Understanding APPI and PCI DSS Compliance in Fintech

For fintech companies expanding into Japan and handling payment card data globally, APPI compliance and PCI compliance are essential to protect personal and financial data while building customer trust. But what is PCI compliance and why does it matter alongside APPI? The Act on the Protection of Personal Information (APPI) enforces strict data protection standards in Japan, while the Payment Card Industry Data Security Standard (PCI DSS) sets global requirements for securing payment card transactions. Knowing what PCI DSS stands for and why it is important is key for financial firms and payment processors.

This guide will show how artificial intelligence (AI) can help with APPI and PCI DSS compliance. AI can automate data handling, improve network security, and simplify compliance processes. With AI, fintech companies can meet APPI and PCI DSS rules. This allows them to focus on growth and making customers happy in the changing payment world.

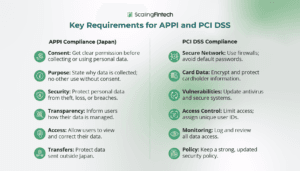

Key APPI and PCI DSS Requirements for Fintech Companies

To comply with APPI and PCI DSS, fintech companies must focus on these main points:

- Clear Purpose for Data Usage: Clearly state why you collect personal and card data. Explain how you will use it.

- Consent Management: Get explicit consent before processing personal data. Have strict controls for cardholder data.

- Security Measures: Set up strong security policies and controls, including data encryption and vulnerability management, to protect data from unauthorized access.

- Record-Keeping: Keep detailed logs of data processing activities. Ensure a secure environment for cardholder data.

- Data Breach Notification: Report data breaches quickly. Do this within 3-5 days for APPI and immediately for PCI DSS.

- Cross-Border Data Transfer: Use safeguards for data transfers outside Japan. Make sure you follow international standards.

Pro-Tip: Conduct regular audits, including PCI DSS audits. This helps ensure your processes match APPI and PCI DSS rules, avoids fines, and builds customer trust in your payment systems.

The Role of AI in Achieving APPI and PCI DSS Compliance

Artificial Intelligence offers fintech companies the tools to move from reactive to proactive compliance. By automating data handling and monitoring, AI enables faster, more accurate risk management for both APPI and PCI DSS compliance.

Key AI Capabilities for APPI and PCI DSS Compliance

- Automated Data Processing: AI can process large volumes of transaction data in real time, flagging potential compliance issues instantly for both APPI and PCI DSS requirements.

- Pattern Recognition: Machine learning models detect unusual patterns, reducing security risks by identifying suspicious activities immediately in payment transactions, enhancing fraud prevention.

- Natural Language Processing (NLP): NLP helps your compliance team stay updated on regulations by analyzing new compliance documents, including updates to the PCI DSS framework.

- Predictive Analytics: AI uses historical data to identify compliance risks early, enabling preemptive measures for both APPI and PCI DSS compliance.

Example: An AI compliance platform can automatically detect anomalies in data handling and credit card transactions, alerting your team to potential breaches and enabling corrective actions before issues escalate.

Tip: Maintain human oversight alongside AI tools to ensure APPI and PCI DSS requirements are met effectively, especially when dealing with sensitive cardholder data.

AI-Powered Solutions for APPI and PCI DSS Compliance in Fintech

AI can turn APPI and PCI DSS compliance from a challenge into a competitive advantage. Here’s how AI helps streamline key compliance areas:

1. Automated Data Processing and Consent Management

AI tracks what users can do on different platforms. It updates consent records automatically to meet APPI rules. It also controls access to cardholder data to follow PCI DSS rules.

Tip: Use a central AI-powered dashboard to see consent history easily. This makes audits simpler and ensures transparency for both APPI and PCI data.

2. Real-Time Data Monitoring and Threat Detection

AI constantly checks data for any suspicious activities. This helps respond quickly to possible breaches in personal and payment card information.

Example: AI looks at transaction data and flags unusual actions with over 90% accuracy. This decreases manual checks and false alerts in payment processing.

3. Data Classification and Access Control

AI tools organize sensitive data, ensuring that only authorized people can access it. This is important for following APPI and PCI DSS rules.

Tip: Use AI to set automatic access limits based on data sensitivity. This helps protect personal information and keeps cardholder data safe

4. Predictive Analytics for Proactive Security

AI analyzes past data to find risks before they happen. This improves data security under APPI and PCI DSS rules.

Example: AI tools review past transactions to spot new compliance risks. This makes your compliance efforts stronger.

5. Automated Reporting and Compliance Audits

AI makes compliance reporting easier, cutting down on manual work. Your organization stays ready for audits related to APPI and PCI DSS.

- Tip: Set up monthly or quarterly automated reports to maintain an up-to-date view of your compliance status, addressing discrepancies before audits, including the annual validation required for PCI DSS.

Benefits of AI-Driven APPI and PCI DSS Compliance Solutions for Fintech

Implementing AI for APPI and PCI DSS compliance offers fintech companies a range of valuable benefits:

Cost Savings and Efficiency

AI automation can reduce compliance-related expenses while increasing operational efficiency in managing both APPI and PCI DSS requirements.

- 49% reduction in operational costs related to compliance.

- 43% decrease in data handling and storage expenses.

- 41% reduction in software engineering costs for compliance-related updates.

Enhanced Data Security and Customer Trust

AI’s continuous monitoring strengthens data security, building customer trust by providing safer data handling practices. Biometric authentication options like facial or voice recognition can further secure customer interactions and enhance PCI DSS compliance.

Scalability and Flexibility

AI-powered solutions grow with your business. These systems scale to handle increasing data volumes and adapt to regulatory changes in both APPI and PCI DSS standards.

- Example: Real-time monitoring and automated reporting enable efficient compliance management, even as transaction volumes increase, reducing processing time and enhancing customer experience while maintaining PCI DSS compliance.

Step-by-Step Guide to Implementing AI for APPI and PCI DSS Compliance in Fintech

Implementing AI in APPI and PCI DSS compliance requires careful planning. Follow these steps to make the transition smooth:

1. Conduct an APPI and PCI DSS Compliance Gap Analysis

Assess your current compliance status to identify gaps. Focus on areas like:

- Data processing workflows

- Security protocols and network security

- Consent management systems

- Documentation, including self-assessment questionnaires for PCI DSS

- Incident response protocols

2. Choose AI Tools that Meet APPI and PCI DSS Requirements

Select AI tools that align with APPI data protection standards and PCI DSS requirements. Look for real-time data monitoring, automated documentation, and end-to-end encryption capabilities.

- Tip: Choose solutions adaptable to future APPI amendments and PCI DSS updates, such as PCI DSS v4.0, ensuring compliance continuity.

3. Train Your Team on AI Compliance Tools

Proper training is crucial for effective AI adoption. Ensure your team understands compliance alerts, AI reports, and data workflows for both APPI and PCI DSS standards.

- Tip: Set clear steps for escalating compliance alerts, ensuring quick and effective responses to potential APPI violations or PCI data breaches.

4. Regularly Audit and Update AI Systems for Compliance

Conduct quarterly audits to verify AI system accuracy and update them as APPI and PCI DSS requirements evolve. Document any changes and ensure your AI tools remain effective for both compliance frameworks.

- Tip: Create an internal compliance team to monitor AI tools and address issues as they arise, balancing automation with human oversight for both APPI and PCI DSS compliance.

Measuring the Success of AI-Driven APPI and PCI DSS Compliance

To track the effectiveness of your AI compliance implementation, establish a measurement framework using these key metrics:

Key Performance Indicators (KPIs) for APPI and PCI DSS Compliance

- Data Security: Track breach detection rates and response times for both personal and payment card data.

- Processing Efficiency: Monitor automation rates and processing speeds for compliance-related tasks.

- Consent Management: Measure consent tracking accuracy and update speed for APPI compliance.

- Documentation: Assess audit readiness and report generation time for both APPI and PCI DSS requirements.

Tracking Cost Savings and Efficiency Improvements

Measure both direct and indirect savings by tracking:

- Operational costs: Reduced compliance expenses for managing APPI and PCI DSS requirements.

- Processing time: Faster customer onboarding and verification while maintaining compliance.

- Resource allocation: Enhanced productivity in IT and compliance operations related to both frameworks.

Evaluating Customer Trust and Data Security Impact

Gauge customer trust and data security improvements with metrics like:

- Customer satisfaction scores

- Reduction in data breach incidents for both personal and payment card data

- Faster response times to security issues in the cardholder data environment

Regularly review and adjust these metrics as APPI requirements, PCI DSS standards, and AI capabilities evolve, ensuring your compliance framework remains effective and adaptable.

How Scaling FinTech Can Help with APPI and PCI DSS Compliance

Scaling FinTech offers AI-driven, APPI, and PCI DSS-compliant advertising solutions tailored to meet the unique needs of fintech companies. Our strategies focus on lead generation, conversions, and sustainable growth, all while strictly adhering to privacy standards and data-sharing frameworks mandated by APPI and PCI DSS.

Why Partner with Scaling FinTech?

- Precision: Customized campaigns aligned with your growth, APPI compliance, and PCI DSS certification goals.

- Transparency: Real-time reporting provides full visibility into campaign performance and compliance status.

- Client-Centric Growth: Designed for impact and ROI, with APPI and PCI DSS compliance as core priorities.

Get Started Today:

Book a free strategy consultation with Scaling FinTech to discover how APPI and PCI DSS compliance can give you a competitive advantage in the evolving landscape of data protection and secure payment processing.

Conclusion: Embracing AI for Efficient APPI and PCI DSS Compliance in Fintech

AI simplifies the complex process of APPI and PCI DSS compliance, enabling fintech companies to reduce costs, improve security, and stay competitive in the fintech industry. By automating data handling, monitoring, and reporting, AI makes APPI and PCI DSS compliance manageable and scalable for financial institutions and payment processors.c

With AI, APPI, and PCI DSS compliance becomes a strategic advantage, helping fintech companies safeguard customer data and maintain secure payment systems while confidently expanding in the Japanese and international markets. Understanding what PCI data is and implementing robust security controls is crucial for fintech companies aiming to meet PCI DSS standards and protect cardholder data security.

For a comprehensive PCI DSS implementation in fintech, companies should work with a Qualified Security Assessor to conduct thorough PCI DSS audits and prepare a detailed Report on Compliance. This process, overseen by the PCI Security Standards Council and supported by major payment card brands, ensures that fintech organizations meet all necessary compliance validation requirements, safeguarding both their operations and their customers’ sensitive information.