Scaling Payment Orchestration & Smart Gateways

100+ High-Intent Merchant Signups in 90 Days – While Reducing CAC by 50%

We help payment orchestrators & smart gateway providers generate at least 100 high-intent merchant signups in 90 days, while reducing CAC by up to 50%.

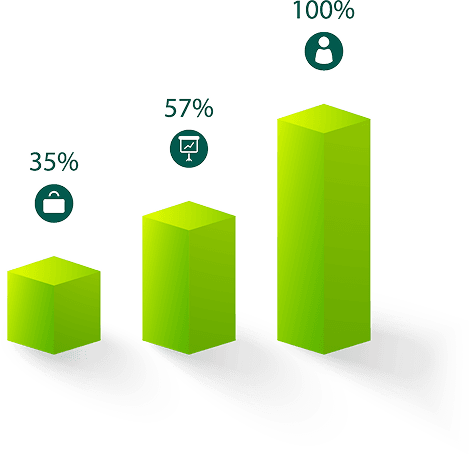

40% of paid traffic is wasted, sending SME & merchant leads straight to competitors.

74% of Payment Orchestrators struggle to convert SME sign-ups into high-value, long-term customers.

59% of merchant accounts fail to become profitable customers.

These silent revenue leaks are capping growth, inflating CAC, and stalling merchant activation.

The firms fixing this now are unlocking faster merchant onboarding, improving retention, and optimizing revenue per transaction.

Those who wait? They’ll see CAC rise while competitors dominate their market.

We spent 1,000+ hours analyzing 200+ payment orchestration & smart gateway GTM strategies, and here’s what we uncovered about reducing acquisition waste, increasing lifetime value, and accelerating merchant activation.

The 5 Biggest GTM Mistakes in Payment Orchestration

Most payment orchestration platforms struggle with high churn, low merchant activation, and wasted ad spend, without realizing why.

59% of Merchant Accounts Never Become Profitable Customers

❌ Not because of churn.

❌ Not because of competition.

✅ Because of a conversion gap in the sales funnel that most providers never fix.

📌 Solution: By refining their onboarding & outbound strategy, leading providers turned inactive sign-ups into high-revenue merchants in just 49 days.

Procurement Bottlenecks Kill 54% of Enterprise Deals

❌ Legal, compliance, and treasury teams stall approvals for months.

❌ Sales teams push technical features instead of procurement-ready solutions.

✅ Winning firms reposition their solution to remove procurement friction, increasing conversion rates by 2.9X.

📌 Solution: Payment Orchestration providers that proactively address procurement concerns accelerate sales cycles by 47% and drive higher merchant adoption.

Post-Signing Activation Fails → Merchants Stay Inactive

❌ Merchants sign up but don’t integrate, leading to lost transaction volume.

❌ Technical complexity slows down onboarding, causing high churn risk.

✅ Winning firms use a high-touch activation strategy to get merchants live faster, tripling active payment volume in 90 days.

40% of Paid Traffic is Wasted, Sending Leads to Competitors

❌ Not because of bad targeting.

❌ Not because of weak offers.

✅ Because of a silent GTM flaw that most teams don’t even know exists.

📌 Solution: The highest-performing platforms fixed this inside their outbound & paid ad strategy, tripling SME merchant sign-ups in 60 days, without increasing ad spend.

74% of Payment Orchestrators Struggle to Convert SME Sign-Ups Into Long-Term Accounts

❌ Not because of pricing.

❌ Not because of competition.

✅ Because of a hidden friction point in the outbound & paid ad funnel that slows adoption.

📌 Solution: The fastest-growing providers identified and removed these bottlenecks—doubling merchant activation rates in just 8 weeks.

59% of Merchant Accounts Never Become Profitable Customers

❌ Not because of churn.

❌ Not because of competition.

✅ Because of a conversion gap in the sales funnel that most providers never fix.

📌 Solution: By refining their onboarding & outbound strategy, leading providers turned inactive sign-ups into high-revenue merchants in just 49 days.

Procurement Bottlenecks Kill 54% of Enterprise Deals

❌ Legal, compliance, and treasury teams stall approvals for months.

❌ Sales teams push technical features instead of procurement-ready solutions.

✅ Winning firms reposition their solution to remove procurement friction, increasing conversion rates by 2.9X.

📌 Solution: Payment Orchestration providers that proactively address procurement concerns accelerate sales cycles by 47% and drive higher merchant adoption.

Post-Signing Activation Fails → Merchants Stay Inactive

❌ Merchants sign up but don’t integrate, leading to lost transaction volume.

❌ Technical complexity slows down onboarding, causing high churn risk.

✅ Winning firms use a high-touch activation strategy to get merchants live faster, tripling active payment volume in 90 days.

40% of Paid Traffic is Wasted, Sending Leads to Competitors

❌ Not because of bad targeting.

❌ Not because of weak offers.

✅ Because of a silent GTM flaw that most teams don’t even know exists.

📌 Solution: The highest-performing platforms fixed this inside their outbound & paid ad strategy, tripling SME merchant sign-ups in 60 days, without increasing ad spend.

74% of Payment Orchestrators Struggle to Convert SME Sign-Ups Into Long-Term Accounts

❌ Not because of pricing.

❌ Not because of competition.

✅ Because of a hidden friction point in the outbound & paid ad funnel that slows adoption.

📌 Solution: The fastest-growing providers identified and removed these bottlenecks—doubling merchant activation rates in just 8 weeks.

59% of Merchant Accounts Never Become Profitable Customers

❌ Not because of churn.

❌ Not because of competition.

✅ Because of a conversion gap in the sales funnel that most providers never fix.

📌 Solution: By refining their onboarding & outbound strategy, leading providers turned inactive sign-ups into high-revenue merchants in just 49 days.

Book a Private Payment Orchestration GTM Strategy Call

Top-performing firms are already fixing these revenue leaks. Are you?

We only offer this to a few firms per quarter to avoid conflicts of interest. If you're serious about scaling merchant acquisition, this is your chance to gain a first-mover advantage.

What You’ll Get from This Call

A proven roadmap to increasing merchant acquisition & eliminating GTM inefficiencies.

A data-backed strategy to reduce CAC while accelerating merchant activation & transaction volume.

No fluff, just actionable insights to help you scale 6- & 7-figure merchant accounts faster.

How Leading Payment Orchestration Providers Scale Faster & Reduce CAC

The firms acquiring merchants & increasing transaction volume fastest are NOT:

Targeting CFOs & CEOs, while ignoring payments teams, finance leaders, and merchants who drive adoption.

Selling speed & cost savings, without proving compliance, multi-rail settlement, and merchant integration ease.

Driving signups without an activation plan, leading to high churn and low transaction volume.

They ARE:

Refining GTM targeting to focus on high-intent merchants, reducing CAC by 50%.

Positioning Payment Orchestration as the primary payment infrastructure, not just an alternative.

Using conversion-focused onboarding & integration strategies, ensuring rapid merchant activation & long-term retention.

Example: One Payment Orchestrator we worked with:

✔️ Fixed their GTM strategy & booked 3X more SME merchant signups in 60 days.

✔️ Optimized their outbound funnel, reducing ad waste by 40% while increasing qualified leads.

✔️ Refined onboarding & activation, tripling active transaction volume in just 90 days.

CASE STUDY

How a Payment Orchestrator 3X’d Merchant Activation in 90 Days

The challenge

A high-growth Payment Orchestration Provider was struggling to turn SME merchant sign-ups into active, high-revenue accounts. Despite generating a steady pipeline of signups, their merchant adoption was stalling, leading to wasted CAC and lower-than-expected transaction volume.

40% of their paid traffic was wasted, sending leads straight to competitors.

74% of signups failed to convert into high-value, long-term merchants.

59% of merchant accounts never became profitable customers.

The real issue?

They were acquiring merchants, but not activating them. Their onboarding and outbound strategy had hidden friction points that slowed merchant integration and blocked long-term transaction growth.

The fix?

We re-engineered their merchant acquisition, onboarding, and activation strategy to drive faster adoption, lower churn risk, and maximize transaction volume.

100+ High-Intent Merchant Signups in 90 Days

The fix?

After a deep GTM audit, we identified five major bottlenecks and deployed a precision-targeted acquisition & activation strategy that eliminated signup friction, fixed onboarding roadblocks, and ensured merchants were live faster.

This payment orchestrator realigned their GTM playbook with these key strategies:

Fixing Paid Acquisition to Unlock High-Value Merchants

- Instead of broadly targeting SMEs, they refined ad targeting & outbound messaging to attract merchants with higher transaction potential.

- Result: 3X more high-value merchant signups in 60 days.

Eliminating Signup Drop-Offs & Merchant Churn

- Instead of hoping merchants would activate post-signup, they implemented a structured onboarding sequence with clear activation milestones.

- Result: 74% signup-to-activation conversion increase.

Positioning Payment Orchestration as the Primary Infrastructure, Not a Backup

- Instead of selling orchestration on speed & cost savings, they reframed it as the merchant’s core payment infrastructure.

- Result: 3X increase in transaction volume per merchant.

Positioning Payment Orchestration as the Primary Infrastructure, Not a Backup

- Instead of selling orchestration on speed & cost savings, they reframed it as the merchant’s core payment infrastructure.

- Result: 3X increase in transaction volume per merchant.

Accelerating Procurement & Compliance Approvals

- Instead of letting finance & legal teams slow down deals, they built pre-approved compliance workflows to remove objections early.

- Result: 47% faster approval cycles & fewer enterprise deal delays.

Embedding Activation Playbooks to Ensure Transaction Volume Growth

- Instead of hoping merchants would start using the platform, they deployed a high-touch activation sequence focused on revenue-driving use cases.

- Result: Merchant activation tripled, ensuring long-term retention & revenue expansion.

The Impact

While most payment orchestrators are stuck with signups that never activate, this firm now drives real transaction volume growth, without increasing acquisition costs.

Merchant activation tripled, by fixing onboarding friction & adoption gaps.

Transaction volume per merchant increased 3X, by repositioning as core infrastructure.

CAC reduced by 50%, by filtering out low-intent SME leads & targeting better-fit merchants.

Enterprise deals closed 47% faster, by eliminating procurement & compliance blockers early.

Key Takeaways for Enterprise Payment Processors

We help enterprise payment processors book at least 15 high-intent sales meetings in 90 days, while shortening deal cycles by 60%.

If your deals are stalling post-verbal approval or failing to generate real transaction volume, you’re likely experiencing these same hidden revenue leaks.

The firms solving this today are securing long-term enterprise partnerships, while competitors keep losing deals to compliance & treasury bottlenecks.

Want to See the Full Breakdown?

We only offer this to a few firms per quarter to avoid conflicts of interest.

Get the proven GTM playbook Embedded Payment providers are using right now.